Changelog

Follow up on the latest improvements and updates.

RSS

You can now invite your customers to create a Resolve dashboard account! For a more detailed guide on how to invite a user, read our Help article here.

To do this, you can click

Invite user

from the kebab menu in the Customers table or from the Actions menu in an individual customer’s details page. If you go to the

Users

tab in a customer's details page, you can view users who have been invited and see when an invite was sent. You can also resend a user invite by clicking the Resend invite

option in the kebab menu of the Users

tab.Please note that in order to successfully send a user invite, the email address domain of the user you wish to invite must match that of the Purchaser/AP email domain on file for that customer.

You can now request to remove the check payment option from the payment methods shown to your customers.

Once enabled, your customers will no longer see the option to pay by check - only ACH, wire transfer, and credit card options will remain available. This setting applies to new invoices going forward and does not affect invoices that have already been sent.

If a customer already has check payment information on file, they may still send checks. These will be processed as usual, and you'll be notified when that happens so you can work with the customer to transition them to other payment methods.

If you'd like this setting enabled or have any questions, reach out to our team, and we’ll be happy to assist.

Webhooks are now live for API-integrated merchants

You can now receive real-time updates from Resolve via webhooks—no more polling our APIs for changes.

Webhooks notify your system automatically when important events occur, including:

- Credit requests being approved or declined

- Invoice and payment status changes

- Customer status updates

This makes it easier to keep your systems in sync and respond to updates as they happen.

Checkout our detailed documentation HERE.

You can set up webhooks in your Resolve Dashboard on the Settings --> Integrations page.

You can now send enrollment emails to pre-approved customers directly from your Resolve dashboard - no more copying links or drafting manual emails.

This new feature simplifies onboarding and ensures customers receive a professional, easy-to-follow experience with automated follow-ups.

What’s included

- A new “Send enrollment email” button is available for customers in Pending Enrollment status

- The email includes a unique, auto-generated enrollment link for that specific customer

- You’ll be CC’d on the first email by default, and can choose to be CC’d on follow-up reminders as well

- Resolve automatically sends up to three weekly reminders if the customer hasn’t enrolled

- You can manually resend the email at any time

- All email activity (initial, reminder, or manual) is logged under Recent Activity

See the Help Article for more details

Hi! We’ve launched a highly requested feature. You can now seamlessly add and credit check multiple customers at once - saving you time and making onboarding much more efficient.

What’s new

- A new Bulk add customers button is now available on the Customers page.

- Option to either add and credit check customers in one steporjust add customers and credit check them later.

- CSV templates are available directly in-app and include upload guidelines.

- The system will validate the data before submission to avoid upload errors.

Key Benefits

- Upload up to 500 customers at once.

- Cut down manual entry and reduce time to launch.

- Ensure all customer records are consistent and credit-checked in bulk.

Where to find it

From the Customers tab, click the new “Bulk add customers” button at the top right. From there, download the appropriate template and follow the CSV upload instructions.

See the Help Article for Full Upload Guide

Hi! We've made some improvements recently to the online application your customers fill out themselves to apply for net terms. These improvements accomplish the following:

- Reduce the number of steps and information required in the application

- Provide context and clarity throughout the application experience to encourage completion

- Streamlined account creation and dashboard set-up to ensure your buyers have access to all the payment benefits Resolve offers

Summary of improvements:

- For businesses doing less than $1 million in revenue per year, the application will outline clearly what information will be required for them to apply (revenue verification, business owner soft credit check, AP contact information).

- Any customer that is approved or sent to manual review will be automatically logged into their Resolve dashboard where they can get familiar with the new payment methods and functionality available to them. Note: this does not happen to customers accessing the application inside an e-commerce store or checkout experience.

- We now allow you to customize the messaging your customers receive when they are declined for net terms. If you are interested in utilizing this, reach out to your Customer Success Manager.

- We reduced the amount of information required and consolidated multiple steps to reduce the length of the application.

Hi! We've streamlined the process of typing invoice details into Resolve using AI. Now, we will use AI to read your invoice file and automatically enter the invoice details in the "Add invoice" modal. The results will be displayed to you so you can verify they are correct and add any details that were missed. More information below:

- First step in adding an invoice will be to upload the invoice file

- It should take about 10-15 seconds for AI to read your invoice

- When finished you will see the invoice fields and your invoice file side-by-side. Be sure to confirm the details are correct.

- After adding invoice details, you can review your invoice before sending

We've released a new feature that allow you to offer customers flexible payment options -- by paying net terms invoices via installments. This helps strengthen relationships with your customers, and help them avoid late fees or impacts to their credit.

How does it work?

When you enable this feature, any buyer in good standing will receive offers to extend their payment due date -- either by 30 days or via installments.

Installment Payment Options:

Customers can pay via monthly or bi-weekly installments over 30 or 60 days on eligible net 30 invoices.

Key Considerations:

- Enabling extensions may delay payouts for invoices with an advance rate less than 100%.

- Customers must be in good standing (no overdue invoices) and the feature must be enabled by the merchant in Settings.

- Payouts for partial advance invoices will be issued when the customer pays, or gradually if they opt for installments.

How to Enable:

Go to Settings > Customer Settings in the dashboard and toggle “Enable Payment Extensions”. Reach out to your Customer Success Manager for help.

Hi! We've built new functionality that will reduce manual back-and-forth for when our underwriting team requests additional financial information from your customers submitted as pre-approval applications. The new improvements should eliminate manual work, speed up time to a credit decision, and continue to give you control over your customer relationships. Details below:

- There is a new required question when submitting a pre-approval application from the Resolve dashboard: “Can Resolve contact this customer directly if additional financial documentation is required?”

- The Resolve underwriting team will trigger an automatic email when they need additional financial information in order to make a credit decision. If you answered "Yes" to the above question, the email will be sent directly to your customer. If you answered "No" to the above question, the email will be sent to you, which will give you the option to send an automated request to your customer directly from your Resolve dashboard.

- Anytime the Resolve team requests you to reach out to your customer for more information, we will identify those pending requests in the "In credit review" tab in your Resolve dashboard. From there you will be able to click "Request additional data" and send the automated email shown above. Alternatively, if you do not wish your customer to provide additional information you can decline our request.

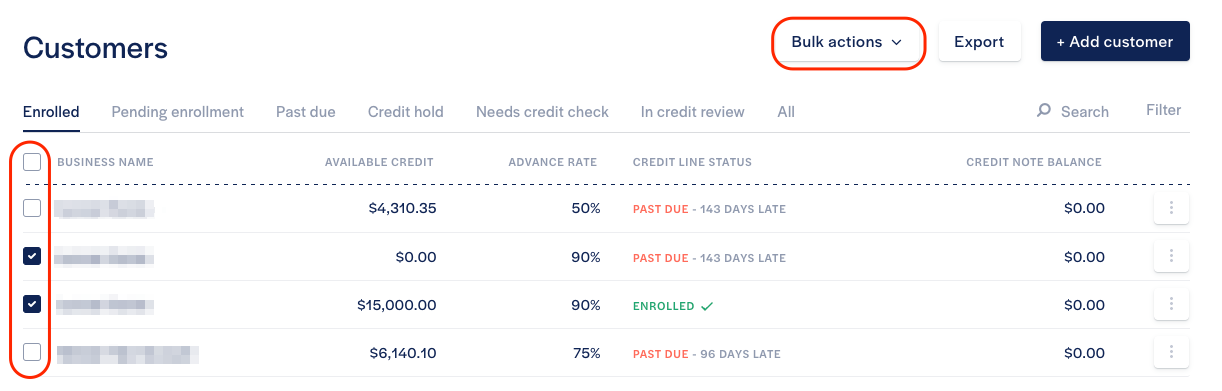

You can now save time by easily bulk archiving your customers and invoices directly from your merchant dashboard. With this new feature, simply select multiple customers or invoices using the checkboxes on the left and archive them in a single action. This feature makes it easier to keep your account current and get rid of irrelevant records.

How it works:

- Navigate to the Customers or Invoices page

- Select the entries you would like to archive with the multi-select on the left

- Use the "Bulk actions" menu to confirm your selection

Important notes:

- Ensure any open balances are closed before archiving a customer or invoice. You are not able to archive records with associated open balances.

- Archived customers and invoices are still accessible and can be viewed by applying the “Archived” filter in the filters menu.

Load More

→